TON’s explosive growth in 2026 - driven by deep Telegram integration, seamless mobile onboarding and a rapidly expanding user base - has created unprecedented demand for fast and reliable cross-chain transfers. With millions of users entering Web3 directly through their messaging app, TON has become a mainstream gateway to crypto activity, and bridging now plays a central role in connecting this massive user flow to liquidity across EVM networks. As more capital circulates between TON and established ecosystems like Ethereum, BNB Chain and Polygon, users expect transfers that feel effortless, predictable and immediate.

To meet this demand, bridge providers have significantly upgraded their infrastructure over the past year. Security frameworks have been tightened through multi-proof validation, more frequent audits and better safeguarding of routing logic. Token support has expanded to include the most actively used assets across the TON ecosystem, particularly stablecoins that dominate payment flows. Combined with improvements in execution speed and fallback mechanisms, these upgrades ensure that bridging maintains stable performance even during intense spikes in network activity.

TON’s high throughput gives it a natural advantage for consumer-facing applications, microtransactions and real-time payments, but this potential can only be realized when cross-chain connectivity remains smooth. Users moving funds from EVM chains expect bridging to work without additional complexity, confusing fees or inconsistent execution times. For retail users who may be interacting with Web3 for the first time, even small friction points can disrupt adoption. Reliable bridging therefore becomes a key structural component of TON’s continued expansion.

This updated 2026 list highlights the bridges that deliver the most stable, transparent and scalable routes between TON and the broader multi-chain environment. These solutions stand out not only for their technical performance, but also for their strong UX and resilience under high traffic - all qualities necessary to support TON’s rapidly growing liquidity needs.

Below are the five top cross-chain bridges currently facilitating TON transactions.

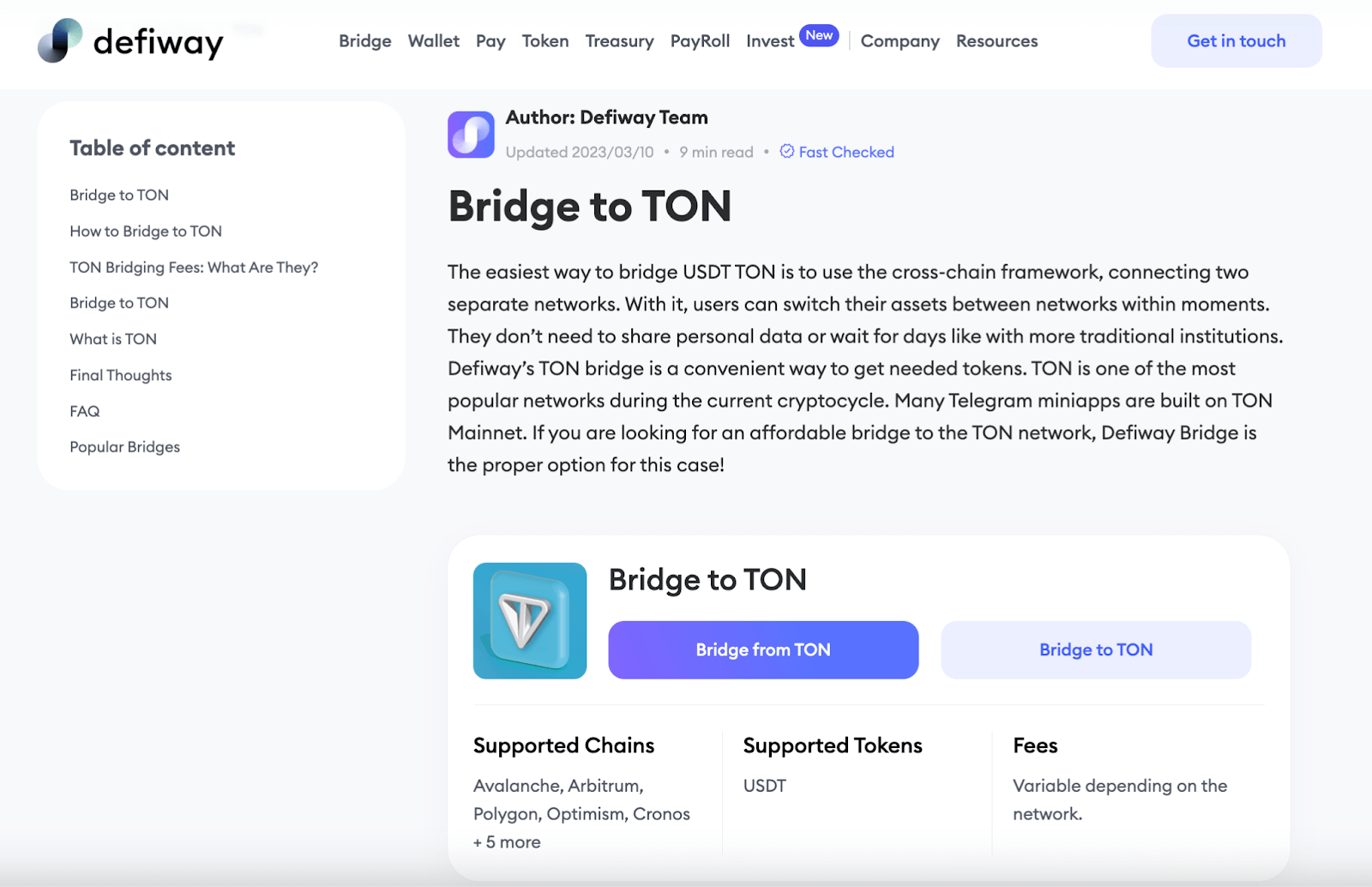

Defiway Bridge

Defiway is the only bridge that supports transactions between TON and 10+ other blockchains, including Ethereum, BNB, Tron, Solana, and Polygon. It provides a fixed fee structure and unlimited volume support, making it ideal for traders and institutions handling large transactions.

Key Features

- Supports 10+ blockchains, including major EVM and non-EVM networks.

- Fixed fee model ensures transparency.

- Unlimited transaction volumes.

- Smart contract audited by Certik, ensuring security.

- No major security breaches reported in nearly two years.

With the rising demand for low-cost, high-speed cross-chain transactions, Defiway is emerging as a go-to solution for liquidity providers and DeFi users.

Symbiosis Finance

Symbiosis Finance provides fast, efficient, and cost-effective bridging through a pool-based liquidity model. This approach optimizes transactions, making it more affordable than some conventional bridging mechanisms.

Key Features

- Supports a wide range of blockchains.

- Optimized for speed and cost efficiency.

- User-friendly interface with an intuitive design.

- Actively developing new features for improved user experience.

Symbiosis is a great choice for users who prioritize speed and efficiency while bridging assets across networks.

TON Bridge

TON Bridge is the official bridge developed by the TON Foundation, ensuring high reliability and seamless integration within the TON ecosystem.

Key Features

- Directly supported by the TON Foundation.

- Provides TON-ETH and TON-BNB transfers.

- Highly secure and officially endorsed.

- Limited token support, primarily focusing on major assets.

This bridge is perfect for those looking for a trustworthy and direct TON-native solution with strong ecosystem backing.

Rubic Exchange

Rubic functions as a best-rate aggregator, scanning multiple DEXs and bridges to ensure users get the most cost-effective swaps.

Key Features

- Aggregates liquidity from multiple DEXs.

- Ensures users receive the best rates for cross-chain swaps.

- User-friendly interface for quick transactions.

Rubic is an excellent tool for traders looking for automated and efficient rate comparison without manual searching.

SimpleSwap

SimpleSwap offers a straightforward swapping experience with minimal complexity, making it perfect for beginners.

Key Features

- Supports a vast range of cryptocurrencies.

- Designed for convenience and simplicity.

- Not the most competitive rates, but ideal for quick swaps.

For users prioritizing ease of use over deep liquidity or best rates, SimpleSwap remains a solid option.

Trends & Industry Insights

The blockchain industry is undergoing rapid transformation, with interoperability emerging as a central theme. Here are some of the key trends shaping the space:

- Rising Adoption of Cross-Chain Bridges: With more blockchains being developed, interoperability solutions are essential for ensuring liquidity and functionality across networks. A report from Messari highlights that over $60 billion in assets are now transferred via cross-chain bridges.

- Security Remains a Top Priority: High-profile bridge hacks, such as the Wormhole and Ronin breaches, have caused losses exceeding $1 billion. As a result, projects are placing greater emphasis on security audits and decentralized validation mechanisms.

- Shift Toward Fixed-Fee Models: As gas fees fluctuate across networks, more bridges, including Defiway, are adopting fixed-fee structures to provide greater cost predictability for users.

- Integration with Layer 2 Solutions: More bridges are starting to integrate with Layer 2 scaling solutions like Arbitrum and Optimism to reduce transaction costs and improve scalability.

- Regulatory Scrutiny: Governments are increasingly monitoring cross-chain activities to prevent illicit transactions. Compliance-friendly bridges are emerging to cater to institutional users.

Conclusion

Among the various options available, Defiway stands out as the most reliable and efficient cross-chain bridge for the TON blockchain. Its support for more than ten major blockchains, transparent fixed fees, and unlimited volume capabilities make it a preferred choice for both institutional and retail users. Additionally, its security measures, including a Certik-audited smart contract, ensure safe transactions.

As TON adoption continues to rise, Defiway’s role in driving interoperability and liquidity within the blockchain space will only become more critical. For users looking for a dependable, fast, and cost-effective cross-chain bridge, Defiway remains the top choice.

FAQ

1. What is a cross-chain bridge?

A cross-chain bridge is a technology that allows the transfer of assets and data between different blockchain networks, enabling interoperability between otherwise isolated ecosystems.

2. Is using a cross-chain bridge safe?

While many bridges implement strong security measures, vulnerabilities do exist. Choosing a bridge that has been audited, such as Defiway (audited by Certik), significantly reduces risks.

3. What are the fees associated with cross-chain bridging?

Fees vary by platform, but some bridges, like Defiway, offer fixed-fee models to ensure predictable costs for users.

4. How long does a cross-chain transfer take?

Transaction times depend on network congestion and the specific bridge used. On average, transfers take a few minutes to an hour, with solutions like Defiway optimizing for speed.

5. Which cross-chain bridge is best for TON?

Defiway stands out due to its support for multiple blockchains, fixed fees, high security, and unlimited volume capacity, making it an excellent choice for TON users.