USD1 is a fully collateralized, dollar-pegged stablecoin launched in 2025 by World Liberty Financial (WLFI).

Each USD1 token is backed 1:1 by real-world assets — cash, short-term U.S. Treasuries, and other cash equivalents. Its reserves are held by BitGo Trust Company, Inc., a regulated U.S. custodian recognized for institutional-grade digital asset storage.

The project’s mission is to simplify cross-border payments and create a reliable on-chain dollar that combines the stability of traditional finance with the flexibility of decentralized ecosystems.

Reserves and transparency: the mechanics behind the peg

USD1 operates on a principle of absolute backing and independent verification. Every token corresponds to a real dollar-denominated asset held in BitGo’s custodial accounts.

World Liberty Financial oversees issuance and ensures the circulating supply of USD1 always matches the total amount of reserves.

Meanwhile, BitGo performs continuous auditing and attestation, providing a level of financial oversight comparable to banking systems — but with full on-chain visibility.

Transparency is further reinforced by The Digital Asset Infrastructure Company (DAIC), which conducts monthly attestations verifying USD1’s reserves. Reports include detailed breakdowns of reserve composition, Treasury allocation, and liquidity structure — allowing users to confirm that every USD1 is fully backed by $1 worth of real assets.

Market adoption and performance

Since launch, USD1 has shown remarkable growth and adoption. As CoinDesk reports, its market capitalization surpassed $2.6 billion, with daily trading volumes in the hundreds of millions. These numbers reflect genuine usage — not speculative hype — as USD1 becomes embedded in DeFi protocols, liquidity pools, and on-chain settlements.

The token has already entered the ranks of the top-50 crypto assets by market cap, solidifying its position as a dependable cross-chain instrument for traders, liquidity providers, and institutions seeking stability without sacrificing decentralization.

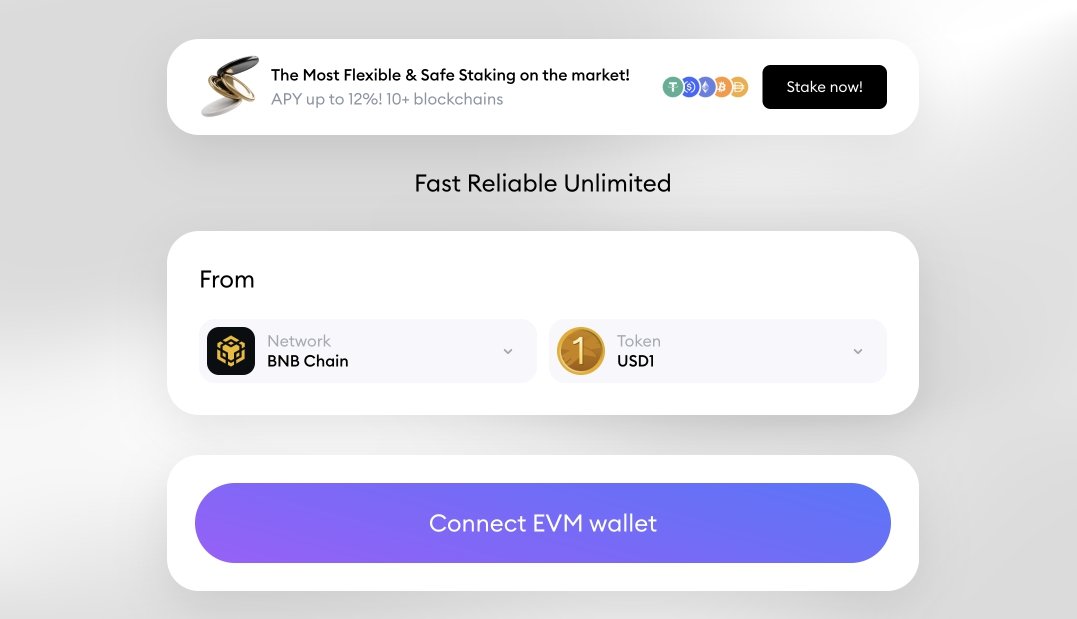

How USD1 works within Defiway

Through its integration with Defiway Bridge, USD1 allows users to manage liquidity across ecosystems quickly and securely.

The unified Defiway interface enables instant transfers, transaction tracking, and the use of USD1 as a core asset in farming, staking, hedging, and lending strategies — all within a single on-chain environment.

Users can already bridge USD1 between BNB Chain and Ethereum. Check the video tutorial.

Key advantages of USD1

1. Fully backed and institutionally custodied (WLFI + BitGo)

Every USD1 is backed 1:1 by liquid reserves held with BitGo Trust Company. World Liberty Financial governs issuance and collateralization, maintaining full alignment between circulating supply and underlying assets.

2. Independently verified reserves (monthly attestations)

Transparency is central to USD1’s credibility. Monthly reserve reports are published and verified by The Digital Asset Infrastructure Company (DAIC), detailing asset composition.

3. Secure cross-chain logic powered by Chainlink CCIP

Its multi-layered verification system protects against bridge exploits, while cryptographic validation guarantees the authenticity of every transaction. As highlighted by PR Newswire, USD1 is one of the first stablecoins to adopt CCIP as a core transport layer — setting a benchmark for DeFi security and interoperability.

4. Growing market adoption (capitalization and volume)

USD1 is now used for staking, yield farming, arbitrage, and cross-chain treasury management — evolving from a mere stablecoin into a foundational layer of on-chain liquidity.

A bridge between two worlds

USD1 represents a new phase in the evolution of decentralized finance — one where the reliability of traditional finance meets the openness of Web3.

Its integration with Defiway Bridge makes that stability truly dynamic: users can move liquidity across ecosystems instantly, securely, and without intermediaries.

Try it yourself

Move your USD1 seamlessly across chains with Defiway Bridge — fast, secure, and 100% on-chain.