USD1 is a regulated, dollar-backed stablecoin you can buy, hold, and bridge easily via Defiway and select exchanges.

Launched in 2025 by World Liberty Financial (WLFI), USD1 has rapidly gained recognition as one of the most transparent and institutionally backed stablecoins on the market. Each token is pegged 1:1 to the U.S. dollar and secured by reserves held by BitGo Trust Company, a U.S.-regulated custodian trusted by institutional investors.

In this article, we’ll walk you through how to buy USD1, where to buy it, and how to bridge or move USD1 between chains. You’ll also learn why this new stablecoin is gaining traction among traders, investors, and businesses looking for a reliable on-chain dollar.

What is USD1 and why it matters

USD1 is a fully collateralized, transparent, and multi-chain stablecoin designed for the next generation of decentralized finance.

Unlike algorithmic or partially backed stablecoins, USD1 is anchored by real-world assets — cash, short-term U.S. Treasuries, and other dollar equivalents — stored with BitGo Trust Company. These reserves are independently verified and audited, making USD1 one of the most transparent stablecoins currently available.

World Liberty Financial (WLFI) acts as the issuing authority, ensuring that every token in circulation matches a real dollar in the reserve. The Digital Asset Infrastructure Company (DAIC) provides independent monthly attestations, publicly verifying that the total reserves equal or exceed the total USD1 supply.

This level of transparency and oversight is rarely seen in DeFi. It’s what makes USD1 particularly attractive to investors seeking a stable, reliable medium of exchange for cross-border payments, yield farming, and portfolio balancing.

Why buy USD1

Buying USD1 offers both security and utility in decentralized ecosystems.

While traditional stablecoins like USDT or USDC dominate the market, they often face criticism over opaque reserve structures or centralized control. USD1 was designed to solve that problem by providing a verifiably backed, regulator-aligned, and chain-agnostic stable asset.

When you buy USD1, you gain access to:

- Full reserve backing — 100% collateralized with cash and U.S. Treasuries.

- Monthly transparency reports — audited and published by DAIC.

- Instant cross-chain mobility — powered by Defiway Bridge and Chainlink CCIP.

- DeFi compatibility — use in liquidity pools, lending, staking, and arbitrage.

Whether you’re a DeFi participant or a business managing cross-chain treasuries, USD1 delivers the balance of security and flexibility that traditional banking and crypto rarely achieve together.

Where to buy USD1

You can buy USD1 directly through Defiway or verified partner exchanges that list the token.

The most straightforward method is through Defiway Bridge, which supports Ethereum and BNB Chain at launch. This approach allows you to swap your existing stablecoins (like USDT, USDC, or DAI) into USD1 instantly without relying on centralized intermediaries.

Here are the main ways to purchase USD1:

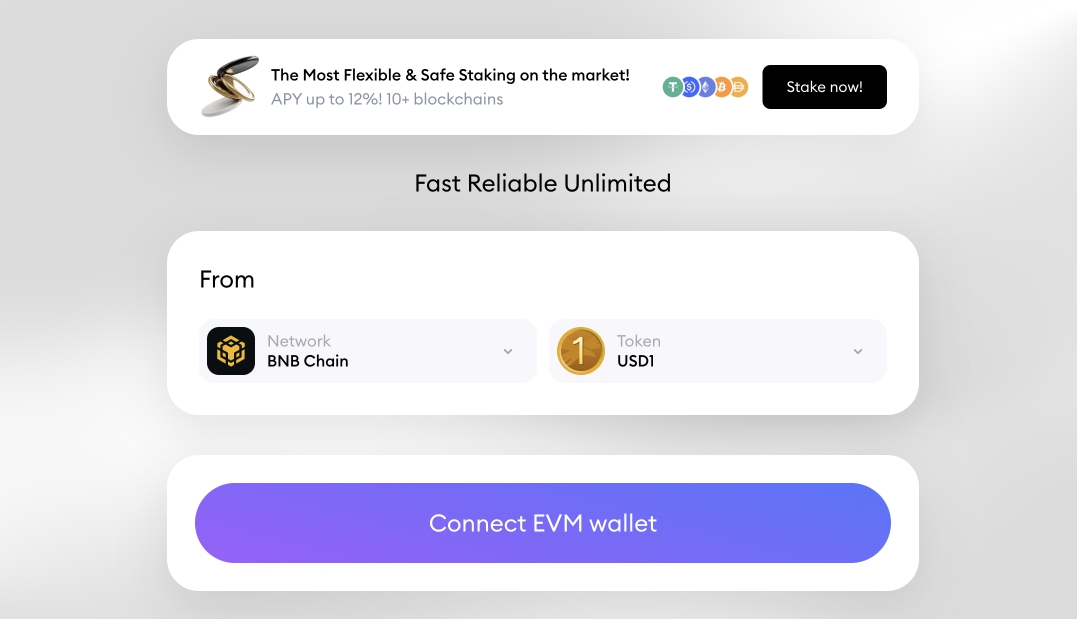

A. Defiway Bridge (recommended)

The Defiway Bridge is an all-in-one cross-chain tool where users can buy, swap, and move assets securely.

- Go to Defiway Bridge.

- Connect your wallet (MetaMask, WalletConnect, Ledger, or any compatible option).

- Choose the network you’re bridging from — e.g., Ethereum → BNB Chain.

- Select the token you’re swapping (e.g., USDT → USD1).

- Enter the amount and confirm the transaction.

- Once approved and confirmed, USD1 tokens will appear in your connected wallet.

B. Partnered Centralized Exchanges (CEX)

WLFI has begun onboarding select centralized exchanges for fiat on-ramps. While availability varies by region, expect listings on tier-1 exchanges to appear progressively. Before transacting, always verify the official USD1 contract address via WLFI’s site or certified explorer links to avoid counterfeit tokens.

C. Decentralized Exchanges (DEX)

You can also buy USD1 on decentralized platforms like:

- Uniswap (Ethereum)

- PancakeSwap (BNB Chain)

- Curve Finance (multi-stable pools)

- Balancer (for portfolio hedging strategies)

Simply connect your wallet, search for USD1, and swap from your preferred token. Ensure you’re using the verified contract to avoid fake liquidity pairs.

How to buy USD1 with fiat

USD1 can be purchased using fiat currencies via supported exchanges or on-chain swap partners.

Some fiat gateways and payment processors connected to WLFI will enable direct USD → USD1 swaps. For example, once integrated with platforms like MoonPay or Transak, users can purchase USD1 using debit/credit cards or bank transfers, automatically receiving tokens in their wallet.

Institutional investors can also acquire USD1 via OTC (Over-The-Counter) desks managed by WLFI’s liquidity partners. This option is ideal for larger transactions that require custom settlement and custody solutions.

How to bridge USD1 across networks

Defiway Bridge enables seamless cross-chain movement of USD1 between Ethereum and BNB Chain.

Cross-chain flexibility is one of USD1’s main advantages. Here’s how it works:

- Go to Defiway Bridge and select USD1 as your token.

- Choose your source and destination chains (for example, Ethereum → BNB Chain).

- Confirm bridge details.

- Defiway verifies your transaction using Chainlink CCIP.

- USD1 is minted or unlocked on the destination network in under a minute.

This process allows traders and liquidity providers to manage USD1 holdings across ecosystems — using it for farming on BNB Chain, lending on Ethereum, or settling payments across networks.

USD1 transparency and security

Every USD1 is backed 1:1 by verifiable assets, audited monthly by DAIC.

Transparency is at the heart of USD1’s design. Monthly reserve attestations detail:

- Composition of reserves — including Treasury bills and cash equivalents.

- Geographical custody details — confirming BitGo Trust’s oversight.

- Total supply reconciliation — proving that every circulating token matches actual reserves.

These reports are publicly accessible, ensuring both retail and institutional holders can verify USD1’s integrity anytime.

Real-world adoption and growth

USD1 has already surpassed $2.6 billion in market capitalization within months of its launch.

According to Prnewswire, USD1’s growth reflects genuine usage — not speculative hype. The stablecoin is now among the top 50 crypto assets by market cap, with hundreds of millions in daily transaction volume.

It is being actively used across DeFi protocols for:

- Liquidity provisioning

- Yield farming

- Hedging and arbitrage

- Cross-border settlements

- Treasury management

This adoption is partly due to WLFI’s transparent structure and Defiway’s simple user interface that eliminates the complexity of multi-chain asset transfers.

Key advantages of buying and holding USD1

USD1 combines the safety of traditional finance with the freedom of DeFi.

Here are its standout advantages:

- Fully collateralized: Every USD1 is backed by real assets held with BitGo Trust.

- Verified transparency: Independent monthly audits ensure ongoing proof-of-reserve.

- Cross-chain liquidity: Move USD1 between major ecosystems via Defiway.

- DeFi integration: Use USD1 for farming, staking, lending, or liquidity pools.

- Security-first design: Built on Chainlink CCIP to prevent bridging vulnerabilities.

- Institutional-grade custody: Governed by WLFI, with clear regulatory alignment.

These features collectively make USD1 one of the most credible and practical stablecoins in the DeFi landscape.

Summary: How and where to buy USD1

You can buy USD1 directly on Defiway, on leading DEXs, or via partnered fiat gateways.

If you want simplicity, Defiway Bridge is the fastest and safest method: connect your wallet, choose your token, swap, and start using USD1 across chains instantly.

As adoption grows, USD1 is positioning itself as the stable backbone of the Web3 economy, merging institutional-grade reserve backing with decentralized accessibility.