Plasma is rapidly becoming a specialized settlement layer for high-speed, low-cost stablecoin transactions. With its EVM compatibility, simplified execution model and flexible gas-payment system that allows fees in whitelisted tokens (including stablecoins).

Why Plasma Needs Reliable Cross-Chain Bridges in 2026

Plasma is built for scalable payments, micro-transactions, global remittances and real-time value transfer. As stablecoin volumes continue to dominate on-chain activity, Plasma stands out as one of the most efficient infrastructures for digital money movement.

Still, no high-performance network can operate in isolation. To reach its full potential, Plasma must remain connected to major liquidity hubs such as Ethereum, Arbitrum, BNB Chain, Polygon, Base and other leading ecosystems. Cross-chain bridges enable this connection by moving liquidity — especially USDT and USDC — from deep-liquidity chains into Plasma’s fast, low-fee environment. Reliable bridging ensures Plasma functions not just as a payment rail, but as an integrated part of the broader Web3 economy.

This 2026 guide highlights the top 10 bridges that truly support the Plasma Network, based entirely on official Plasma documentation and verified integrations.

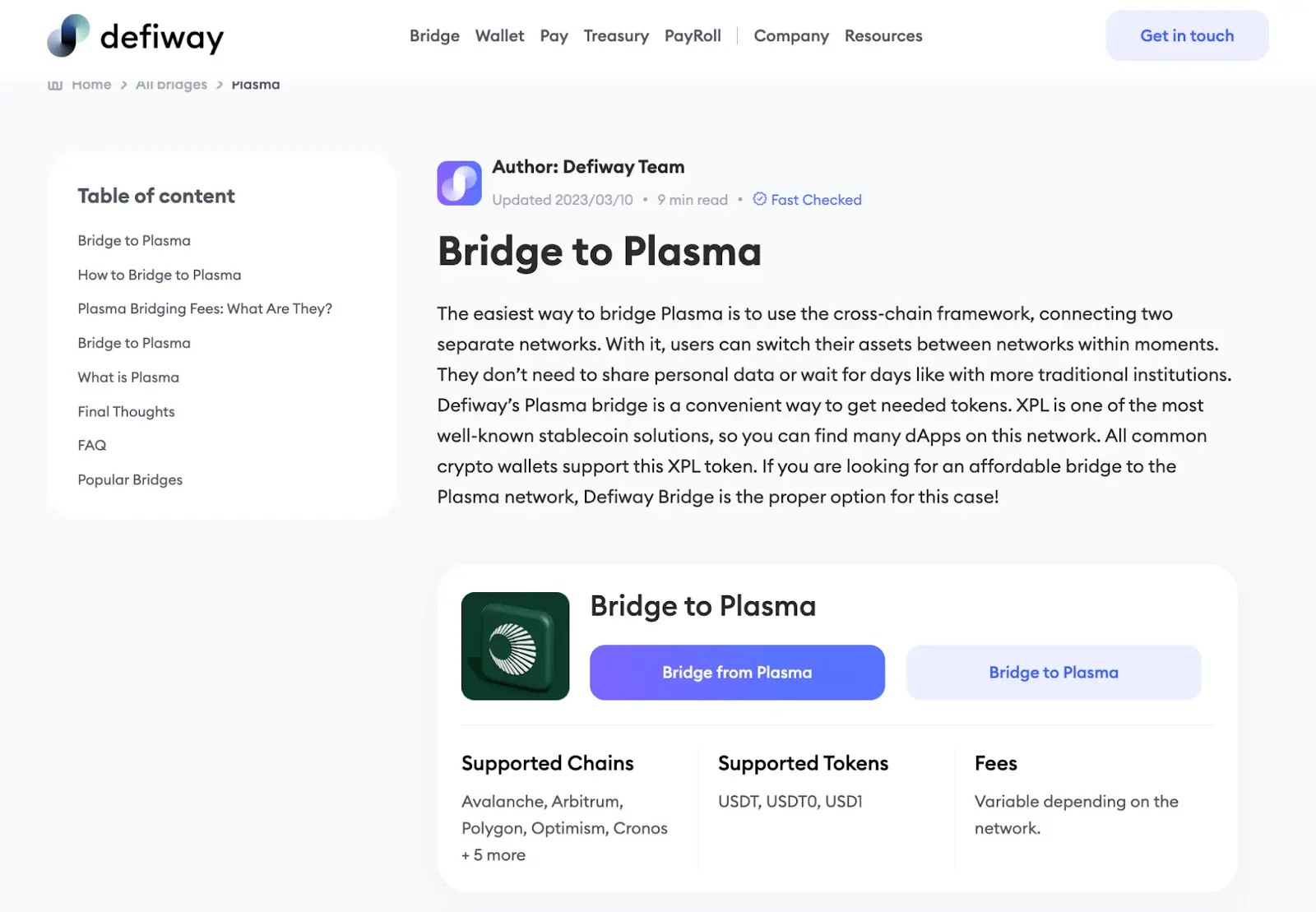

Defiway Bridge

Defiway Plasma bridge offers the smoothest and most intuitive way to move stablecoins into Plasma. The system is designed explicitly around fast cross-chain flows, with predictable settlement times and a clean UI that simplifies onboarding for both beginners and advanced users. Flat 0.2% commission makes transaction costs predictable. Also, Defiway is one of the only places where users can bridge any amounts of USDT and USDC across EVM chains, Tron, Solana, Bitcoin, TON, and Plasma (obviously).

Key Advantages

- 13+ blockchains support

- Any directions, any amounts

- Non-custodial, audited smart-contract infrastructure

- Minimal slippage and transparent fixed fees

- Seamless UX tailored for Plasma entry

For users bridging assets for payments, remittances, liquidity operations or on-chain activity, Defiway Bridge remains the recommended primary route into Plasma.

deBridge

deBridge is one of the core multichain technologies officially listed by Plasma. It provides secure bridging and advanced cross-chain messaging via a validator set using multi-proof verification. Its routes to Plasma offer predictable execution and high reliability for stablecoins.

Why It Works Well for Plasma

- Enterprise-grade security

- Robust stablecoin routing

- Transparent and predictable fees

- Proven performance under high load

Ideal for large transfers and users who prioritize strong security guarantees.

Symbiosis

Symbiosis is one of the few bridging protocols that explicitly built native support for Plasma , offering direct routes for USDT, WXPL and other supported assets. It provides one-click swaps and automatic routing.

Highlights

- Native Plasma integration

- Simple UI for beginners

- Stablecoin-friendly routing

- Automatic DEX-based execution for best rates

A top choice for users who want straightforward, frictionless bridging into Plasma.

LayerZero

LayerZero is officially recognized by Plasma as one of the chain’s primary interoperability technologies. It provides omnichain messaging that powers several bridge products and enables secure, lightweight transfer flows.

Strengths

- Trusted messaging backbone

- Used by multiple bridge frontends

- High security standards

- Reliable cross-chain execution

A foundational protocol for applications and wallets bridging into Plasma.

Stargate

Stargate acts as the liquidity transport layer on top of LayerZero. It provides deep liquidity pools for stablecoins and supports instant, low-slippage transfers to networks that integrate LayerZero messaging — including Plasma.

Why It’s Strong

- Large stablecoin liquidity pools

- Native cross-chain execution

- Consistent routing

- Low slippage, even for larger transfers

A strong pick for high-volume stablecoin flows.

Relay

Relay is listed in Plasma’s cross-chain infrastructure tools and is known for its smooth, stable execution across multiple EVM networks. It provides reliable routing for major stablecoins and ERC-20 tokens.

Key Features

- Consistent performance

- Supports multiple popular chains

- Good UX for everyday users

- Predictable, transparent fees

Relay is a practical, stable choice for users bridging frequently.

Jumper (LI.FI-Powered)

Jumper is a cross-chain aggregator built on top of LI.FI, and it is officially included in the Plasma interoperability ecosystem. It aggregates many bridges and chooses the best route automatically.

Advantages

- Multiple bridges under one interface

- Smart routing across chains

- Fast execution paths

- Excellent UX for newcomers

Ideal for users who simply want “the best route” without worrying about technical details.

Across

Across is one of the most efficient EVM-focused bridges and is officially listed by Plasma as part of its cross-chain tooling. Known for its speed and low-slippage stablecoin transfers, it offers reliable support for moving assets into Plasma from popular L1s and L2s.

Why It’s Useful

- Fast stablecoin settlement

- Strong liquidity for EVM routes

- High routing efficiency

- Minimal trust assumptions

Perfect for power users who prioritize execution quality.

Hyperlane

Hyperlane is a modular interoperability protocol also listed in the official Plasma ecosystem. It provides secure, permissionless messaging and serves as a backbone for cross-chain transfer flows and decentralized applications.

Highlights

- Permissionless cross-chain messaging

- High flexibility for dApps

- Secure routing architecture

- Strong support for EVM ecosystems

Widely used for application-level cross-chain operations and bridging logic.

Conclusion

Plasma is becoming one of the most efficient payment-layer blockchains in Web3, offering fast settlement, low fees and scalable stablecoin operations. Reliable bridging is what connects Plasma to global liquidity, enabling both consumer and institutional-grade use cases.

The bridges in this list are officially recognized, functionally integrated or verified to support Plasma, providing the strongest combination of security, liquidity, speed and user experience. Whether you’re transferring stablecoins, onboarding liquidity or building applications, these 9 bridging solutions represent the most trustworthy and effective pathways into Plasma in 2026.

Among the bridges mentioned, Defiway stands out. This bridge offers excellent liquidity, allowing you to bridge any amount without issues. Its speed and fees are also top-notch. Moreover, Defiway's support for the Solana, TON and all major EVMs sets it apart from other options.