Tron continues dominating global stablecoin settlement in 2026, consistently processing enormous USDT volumes. Thanks to its high throughput and predictable performance, Tron remains a preferred environment for payment flows, international remittances and high-frequency transfers that require stable finality and minimal cost. As the network grows beyond traditional retail usage and attracts institutional-grade payment channels, the demand for reliable cross-chain connectivity has never been higher.

Because Tron’s ecosystem is heavily centered around stablecoins, users expect bridging routes that execute quickly, remain transparent and avoid any unnecessary slippage. Even small delays or inconsistent settlement times can disrupt liquidity flows that rely on precise timing, especially during periods of heightened market volatility. Bridge providers have responded by upgrading security frameworks, integrating multi-layer audits and optimizing routing paths to reduce friction when sending assets between Tron and major EVM networks.

Over the past year, bridging infrastructure has matured significantly, with wider token support, improved bandwidth allocation and better routing logic designed specifically for stablecoin-heavy traffic. These enhancements allow transfers to remain efficient even during peak usage hours, when networks are congested and liquidity demand is spiking. The best bridges now combine deep liquidity pools with automated execution paths that ensure transfers remain smooth regardless of market conditions.

This 2026 update highlights the bridging solutions that offer the most dependable entry points to and from Tron, providing users with routes that deliver consistent performance and high security. Whether you’re managing remittances, moving stablecoin liquidity or participating in arbitrage and high-frequency strategies, these bridges represent the most reliable ways to connect the Tron ecosystem with the rest of the multi-chain world.

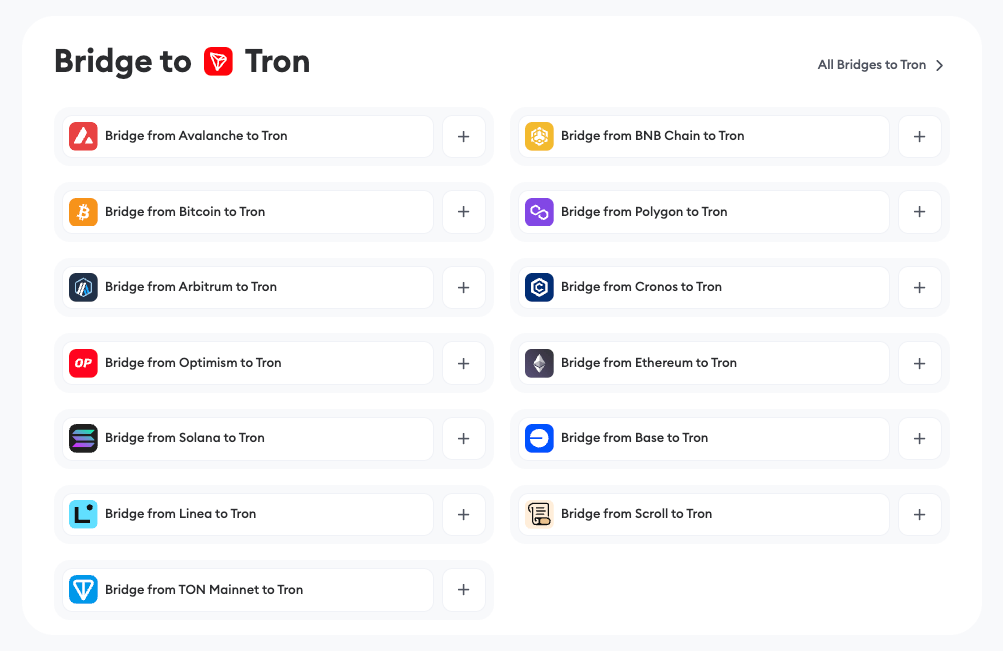

Below, we explore the top cross-chain bridges empowering Tron’s interoperability.

Defiway

Defiway tops the list with its seamless integration into the Tron ecosystem. It offers a fixed transaction fee of 0.2%, and processes transfers in under one minute. Security is prioritized through multi-signature protocols and audits, while its mobile app supports cross-chain swaps and multi-currency wallet. Defiway stands out for its broad blockchain support, including Tron—a rarity among bridges—making it ideal for users seeking speed, affordability, and reliability. Defiway allows users to bridge any amounts of USDT TRC-20 to/from 12 other blockchains.

Defiway supports not only various EVM networks and Tron, but also TON and Solana. Defiway’s smart contracts are audited by Certik.

Stargate Finance

Built on LayerZero, Stargate enables native asset transfers across 18+ chains, including Tron. Its unified liquidity pools eliminate wrapped tokens, ensuring instant finality and minimizing slippage. Stargate’s security is reinforced by audits and a Delta (Δ) algorithm to prevent liquidity exhaustion. The platform also offers dynamic fee adjustments via its AI Planning Module, balancing demand and efficiency.

BNB Chain Bridge

Operated by Binance, this bridge connects Tron to the BNB Smart Chain ecosystem. Its integration with Binance’s infrastructure ensures reliability and access to deep liquidity. However, centralized custody poses slight custodial risks, offset by Binance’s robust security standards.

Rhino Fi

Rhino Fi leverages StarkEx Validium for secure, self-custodial bridging to Tron and 27+ other chains. Its emergency withdrawal feature allows users to retrieve funds even if the platform goes offline, backed by Ethereum’s security. Fees start at 0.3% for swaps, decreasing with higher trading volumes.

Rubic Exchange

Rubic combines cross-chain swaps and bridging across 27+ chains, including Tron, with a flat $2 fee. Its one-click DeFi interface simplifies complex transactions, while audited contracts ensure safety. However, gas fees on destination chains can add to costs.

Allbridge

Focused on stablecoins, Allbridge connects Tron to Solana, Ethereum, and others via a decentralized pool model. It uses a consensus mechanism among validators to secure transfers, with fees averaging 0.3%. Users can also stake tokens for governance rewards.

TokenPocket

TokenPocket’s integrated wallet and bridge support Tron alongside EVM chains. While user-friendly, its exchange routes can incur fees up to 0.5%, necessitating careful comparison before transactions.

Meson Fi

Meson Fi is a cross-chain bridge protocol focused primarily on stablecoins, designed to facilitate fast and cost-efficient transfers across multiple blockchain networks. It supports over 20 networks, including both EVM-compatible (like Ethereum, Binance Smart Chain) and non-EVM chains. Meson Fi stands out for its optimization of stablecoin swaps, boasting low slippage and transaction times as quick as 1-2 minutes, depending on network confirmation speeds. It uses a unique approach with meta-transactions, where liquidity providers cover gas fees, reducing costs for users.

Symbiosis

Symbiosis is a cross-chain automated market maker (AMM) and liquidity protocol that doubles as a bridge, enabling seamless token swaps and asset transfers across more than 30 blockchain networks, including Ethereum, Polygon, Arbitrum, and even non-EVM chains like Tron and Solana. Supporting over 1,000 tokens, it aggregates liquidity from various decentralized exchanges and pools, offering users low fees and minimal slippage for “any-to-any” token swaps in a single transaction. Symbiosis leverages a decentralized relayer network to validate and process cross-chain transfers, enhancing security and interoperability.

Conclusion

Tron’s cross-chain ecosystem thrives on bridges like Defiway and Stargate, which balance speed, cost, and security. As interoperability grows, users should prioritize platforms with audited contracts, transparent fees, and Tron-specific support.

Among the bridges mentioned, Defiway stands out. This bridge offers excellent liquidity, allowing you to bridge any amount of USDT TRC-20 without issues. Its speed and fees are also top-notch. Moreover, Defiway's support for the Solana, TON and all major EVMs sets it apart from other options.