So you’ve got some coins stuck on another chain. ETH, BNB, Polygon, BTC. And you’re staring at Tron thinking… I actually need that TRC-20 USDT because, let’s be real, half of crypto’s stablecoin economy still runs there. Yes, most of the DeFi action takes place on other networks, but Tron is very good at P2P, financial settlements, and other things.

And bridging from Tron? Same story. Sometimes you need to exit. Move liquidity out. Maybe you’re farming somewhere else, or you just want to dump back to Ethereum for liquidity. Point is: two-way traffic. Let’s unpack it.

What Even Is a Blockchain Bridge?

Quick refresher (if you’re new here). A blockchain bridge = a service or protocol that lets you move tokens between networks. Like, you lock coins on one side, a smart contract or custodian confirms it, then a wrapped version pops up on the other side. Sometimes fully decentralized, sometimes semi-custodial, sometimes “trust me bro” solutions.

They’re not magic. They’re tech + liquidity pools + validators. And in 2025, after years of hacks and rugpulls, the survivors are mostly battle-tested.

Why Tron?

Short version: fast, stablecoin-heavy.

- Speed: blocks confirm in like 3 seconds.

- Ecosystem: still huge for Tether, USDT-TRC20 is probably the most used stablecoin variant on the planet.

- Fees? Justin Sun (Head of Tron) promised to reduce commissions by 60%. We are watching and waiting.

So if you’re doing arbitrage, remittances, or just don’t want to burn ETH gas… bridging to Tron makes sense.

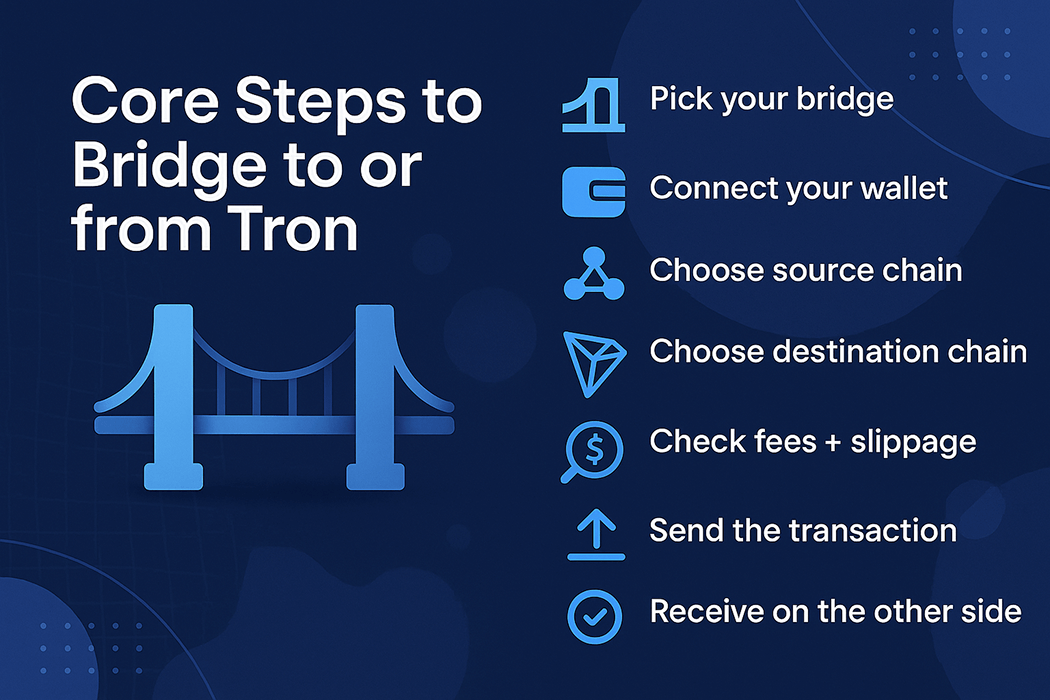

Core Steps to Bridge To or From Tron

Let me break it down simple. Doesn’t matter if you’re going ETH → TRX or TRX → BNB, the flow is basically the same:

- Pick your bridge. (More on which ones are worth using below).

- Connect your wallet. MetaMask, TrustWallet, TronLink, whatever you use.

- Choose source chain + token. Could be ETH, POL, BNB, ARB etc.

- Choose destination chain. Tron in this case. Or vice versa if you’re leaving.

- Check fees + slippage. Don’t ignore hidden bridge costs.

- Send the transaction. Sometimes you wait 30 seconds, sometimes 20 minutes. Chill.

- Receive on the other side. If it’s TRC-20, you’ll see it in TronLink or your supported wallet.

That’s it. Process is dumb simple when you’ve done it a few times. The devil’s in the details—like which bridge you trust, what fees you pay, and whether you’re bridging stablecoins or native assets.

Top Tron Bridges in 2025 (Ranked Listicle)

Alright, the juicy part. Which services actually work, right now, without you crying over missing funds. My list—personal, subjective, but hey, you asked.

1. Defiway Bridge

This one's go-to. Why? Multi-chain coverage, smooth UX, and—big thing—consistent liquidity. A lot of bridges choke when volumes spike, but Defiway seems to handle flows without insane slippage. Plus, they’ve integrated Tron properly, not some half-baked wrapped setup. If I had to recommend one bridge in 2025 for Tron moves—this is it.

2. Stargate

Built on LayerZero, Stargate enables native asset transfers across 18+ chains, including Tron. Its unified liquidity pools eliminate wrapped tokens, ensuring instant finality and minimizing slippage.

3. Rhino Fi

Rhino Fi leverages StarkEx Validium for secure, self-custodial bridging to Tron and 27+ other chains.

4. CEX Bridges (Binance, OKX internal transfers)

Not a real bridge per se, but let’s be honest—tons of people just deposit ERC20 USDT on Binance and withdraw TRC20. Centralized, but simple. Definitely not suitable for large sums.

5. Symbiosis

Symbiosis is a cross-chain automated market maker (AMM) and liquidity protocol that doubles as a bridge, enabling seamless token swaps and asset transfers across more than 30 blockchain networks, including Ethereum, Polygon, Arbitrum, and even non-EVM chains like Tron and Solana.

Pro Tips (Stuff Users Learn the Hard Way)

- Always test small. If you're a newbie, send like $10 before you send $5k. If it fails, you just paid for coffee, not a funeral.

- Check bridge fees. Some charge “network fee + protocol fee.” You can lose 1-3% if you’re careless.

- Watch for downtime. Bridges get congested. Or under maintenance. Or randomly buggy.

- Stablecoins vs. Native Assets. Bridging USDT = smooth. Bridging weird tokens = often pain.

Bridging From Tron Back Out

Same drill in reverse. The trick is making sure your receiving wallet supports the target chain. Example: You’re moving TRC-20 USDT → ERC-20 USDT. You’ll need Ethereum gas to claim/spend it on the other side. Always keep a tiny stash of native coin for gas (ETH, BNB, etc.).

Common Mistakes People Still Make

- Sending to an unsupported wallet.

- Forgetting gas on destination chain.

- Picking random shady link they saw on Twitter or Google.

- Ignoring slippage—thinking “oh, I’ll get 1000 USDT,” but actually landing 950.

Is Bridging Safe in 2025?

Safer than 2021, but not bulletproof. Remember Ronin hack? Poly hack? Yeah, bridges were juicy targets. These days, audits are better, insurance is sometimes included, and UX is smoother. But nothing in crypto is “100% safe.”

Rule of thumb: stick to big names, test small, don’t ape blindly.

Wrapping It Up

So yeah. Bridging to Tron in 2025 is still a practical move if you’re chasing cheap USDT transactions, or you just need to interact with Tron’s ecosystem. Bridging from Tron is equally common when you want to rejoin liquidity on ETH/BNB/etc.

Personal pick? Defiway Bridge. Works. Doesn’t overcomplicate things. Fees are fair. And most importantly, it’s alive, liquid, and user-friendly.

End of the day, bridging isn’t rocket science. Pick the right tool, double-check addresses, send a test transaction, and you’re golden.