Polygon continues maturing as a multi-chain ecosystem in 2026, backed by the combined strength of Polygon PoS, Polygon zkEVM and a suite of unified liquidity initiatives that make the network attractive to both developers and enterprises. With significant activity across DeFi, gaming, institutional finance and large-scale consumer applications, Polygon has become one of the most versatile and widely integrated ecosystems in Web3. This scale naturally increases the importance of stable, predictable and efficient cross-chain connectivity, as users frequently move assets between Polygon and major liquidity hubs.

Because liquidity on Polygon flows constantly between its own sub-networks and external ecosystems, users expect bridges to provide routes that are not only fast but also cost-effective and secure. Even small inefficiencies—unpredictable fees, settlement delays or high slippage—become major pain points when interacting with high-volume DeFi protocols or consumer-facing products. Bridge providers have responded by enhancing routing engines, tightening their audit frameworks, and expanding support for a wider range of assets, especially stablecoins and core ERC-20 tokens heavily used across Polygon’s ecosystem.

Over the last year, Polygon’s growing adoption has pushed bridging infrastructure to evolve in tandem, introducing better execution paths, deeper liquidity pools and smoother user experiences. These improvements ensure that transfers remain reliable even during peak on-chain activity, when thousands of users interact with dApps, gaming platforms and trading tools simultaneously. As Polygon continues to scale horizontally through its multi-chain architecture, the quality of bridging infrastructure directly influences the network’s usability and liquidity efficiency.

This updated 2026 list highlights the bridges that consistently deliver strong performance when moving assets to and from Polygon, focusing on reliability, cost efficiency and route transparency. Whether users are participating in DeFi strategies, gaming transactions, institutional liquidity flows or retail activity, these bridges provide the most seamless and trusted pathways across the Polygon ecosystem.

Some key features of Polygon include:

- High transaction speed: Polygon can process thousands of transactions per second, making it suitable for dApps that require fast and efficient execution.

- Low transaction fees: Compared to Ethereum, Polygon offers significantly lower transaction fees, making it more affordable for developers and users.

- Compatibility with Ethereum: Polygon is fully compatible with the Ethereum Virtual Machine (EVM), allowing developers to easily port their Ethereum-based dApps to the Polygon network.

- Security: Polygon uses a hybrid proof-of-stake (PoS) consensus mechanism, ensuring the security and reliability of the network.

Here are the top 9 Polygon cross-chain bridges

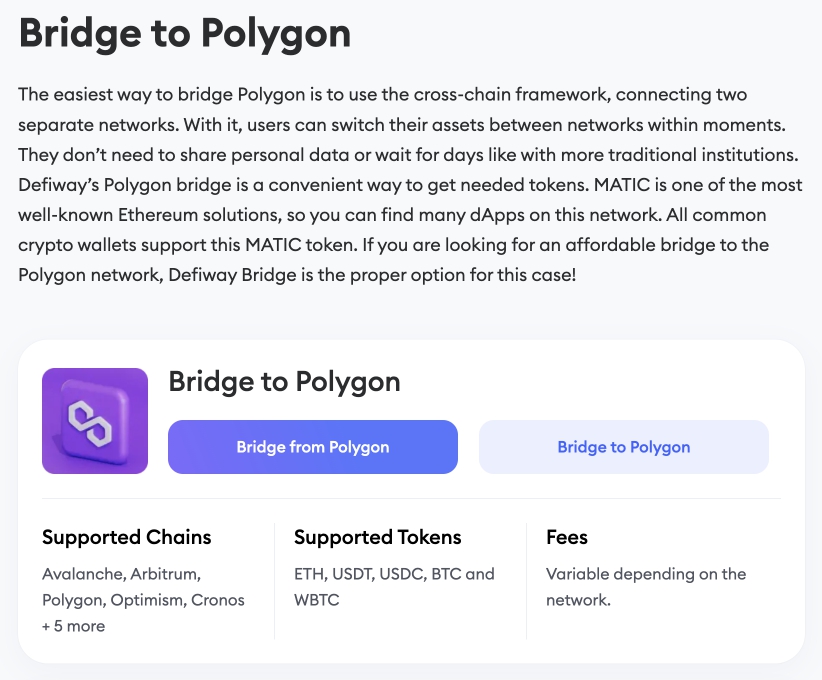

Defiway

A decentralized bridge that supports 10+ blockchains, including Ethereum, Binance Smart Chain, and Avalanche. It offers competitive fees and a user-friendly interface.

Defiway supports not only various EVM networks, but also Tron and Solana. Defiway’s smart contracts are audited by Certik. There were no hacks or other incidents involving this cross-chain bridge during its lifetime (Defiway is on the market for almost 2 years).

Polygon PoS Bridge

The official bridge for the Polygon network, providing a secure and reliable way to transfer assets between Polygon and Ethereum.

Across

A high-performance bridge that focuses on speed and efficiency. It supports a wide range of blockchains, including Ethereum, BNB Chain, and other EVM chains.

Stargate

A cross-chain bridge that supports a wide range of blockchains. It offers competitive fees and a user-friendly interface. One of the features is choosing transfer type: Fast to move assets quickly or Economy to move assets cheaply.

Synapse

A secure and scalable bridge supporting over 30 blockchains, ideal for large-scale transfers. It is one of the most popular cross-chain bridges with over $1 billion in total value locked (TVL). Synapse also has Staking, Pools, and Explorer.

Orbiter

A bridge prioritizing security and reliability, using a multi-signature mechanism. Supports over 20 blockchains.

Hop

A decentralized bridge that offers a simple and secure way to transfer assets between different blockchains. It supports a wide range of networks and provides a user-friendly interface.

Meson

A cross-chain bridge focused on security and efficiency, supporting over 20 blockchains.

Symbiosis

A decentralized bridge supporting over 20 blockchains, offering a user-friendly interface and competitive fees.

Final thoughts

The ideal Polygon bridge for you depends on your specific requirements. Factors to consider include the supported blockchains, fees, security, and user experience. Before making a decision, it's recommended to research and compare various bridges.

Among the bridges mentioned, Defiway stands out. This bridge offers excellent liquidity, allowing you to swap any amount without issues. Its speed and fees are also top-notch. Moreover, Defiway's support for the Solana and Tron networks sets it apart from other options.